Some of the letters I’ve received refer to “flexible annuity/flexible annuity rider”. The statements I have received say”plan code 000022-Roth”. I am 56 years old so I am concerned if this distribution is treated as a non qualified annuity where I’d have to pay a penalty and tax on the gains and interest is paid out first. If it is a Roth then no tax or penalty because the distribution rules for Roth say principal paid out before interest and you can withdraw principal at any age without penalty. I guess I am confused as to what I have and confused about an annuity disguised as a Roth.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Colorado Bankers (CB Life)...

- Thread starter FETalk

- Start date

- 4,575

sure sounds like you have a Roth.Some of the letters I’ve received refer to “flexible annuity/flexible annuity rider”. The statements I have received say”plan code 000022-Roth”. I am 56 years old so I am concerned if this distribution is treated as a non qualified annuity where I’d have to pay a penalty and tax on the gains and interest is paid out first. If it is a Roth then no tax or penalty because the distribution rules for Roth say principal paid out before interest and you can withdraw principal at any age without penalty. I guess I am confused as to what I have and confused about an annuity disguised as a Roth.

Do you have your original policy packet? It should say in the front what type it is & also, your original application copy should be in the back of the policy jacket where you should see your original application.

Lastly, do you receive annually or at least in the year it was started an IRS form 5498? That is a form the IRS uses for somewhat tracking deposits or valuations of qualified plans. https://www.irs.gov/pub/irs-pdf/f5498.pdf

Honestly I have no idea where the policy information is. I kept it at work in my files and changed jobs once and retired since I started this cursed investment. I guess I was hoping someone would recognize that code “000022-Roth” and know if is treated as a Roth IRA or a non qualified annuity as far as withdrawal order, taxes, and penalties.

- 4,575

Honestly I have no idea where the policy information is. I kept it at work in my files and changed jobs once and retired since I started this cursed investment. I guess I was hoping someone would recognize that code “000022-Roth” and know if is treated as a Roth IRA or a non qualified annuity as far as withdrawal order, taxes, and penalties.

I doubt you will find agents on here that wrote CBL annuities, most were sold through banks if I remember correctly.

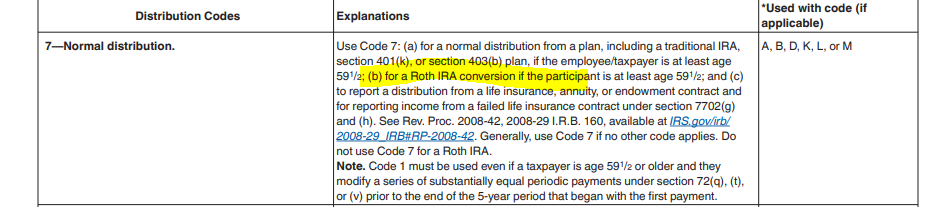

Have you taken money out of this account at all in the past? or did you take the 25% out last fall? If so, your 1099R that they sent you should have the tax code on the 1099 R. I believe the Distribution code in BOX 7 will show as 7b for a ROTH, but 7a for regular IRA or NQ Annuity

Similar threads

- Replies

- 10

- Views

- 1K

- Replies

- 45

- Views

- 2K