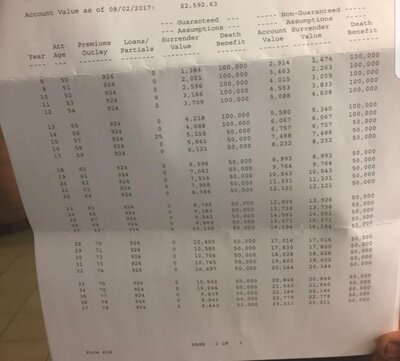

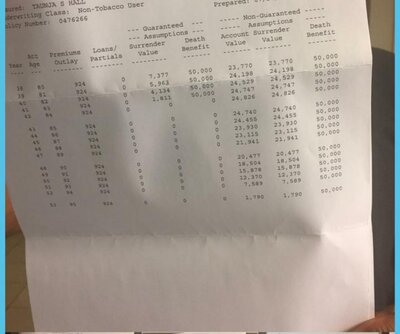

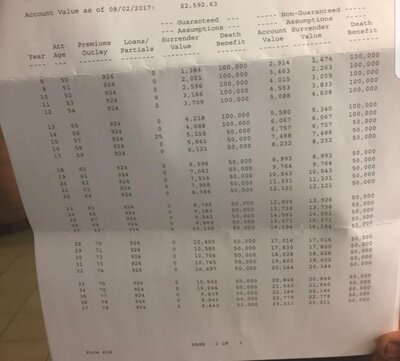

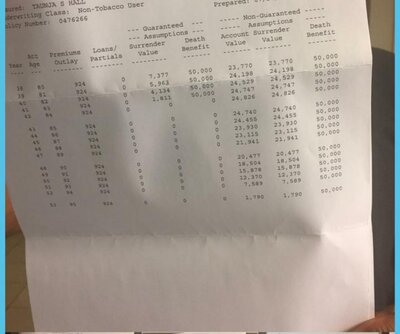

ok basically woman currently has UL policy for 100k benefit but will drop to 50k in a few years to extend coverage and based on her latest guaranteed assumptions will run out of cash value and benefit at age 83 based on current premium. I got her signed up for a whole life with 35k death benefit which projects a cash value of $20000 at age 83 at same premium shes paying now. Anyway she calls today and wants to cancel because the other company and agent are telling her to look at the other column which clearly states non guarananteed assupmtions and that her policy wont end up canceling at 83 and agent told her in his 30 years hes never seen one run out. I attatched her current illustrations and then the one I have offered her. Am I not helping her out and offering her a better value? What do the non guaranteed assumptions mean? And if I am giving her a better value what should I say to convince her not to cancel the whole life? Thanks Guys

View attachment img20170815_13510712.pdf

View attachment img20170815_13510712.pdf