- Thread starter

- #131

- 11,275

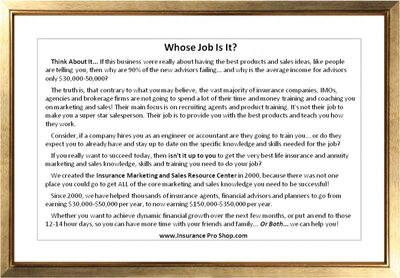

Just stumbled onto this video on YouTube. Michael Kitces primarily writes his blog and his materials for the financial advisor/RIA market. However, if you're offering comprehensive life insurance planning and retirement planning with annuities (as taught by the Insurance Pro Shop that I highly recommend or any other selling system/method), this is a FANTASTIC way to craft your professional introduction and bullet points of what you do and who you do it for.

This is my preferred method of prospecting/introducing myself, but I have customized my talking points relevant to my products and what they do for the people I work with.

This is my preferred method of prospecting/introducing myself, but I have customized my talking points relevant to my products and what they do for the people I work with.

Last edited by a moderator: