- 8,448

Friday, March 13, 2015

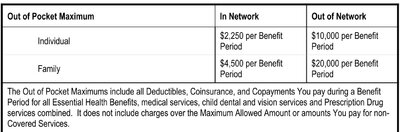

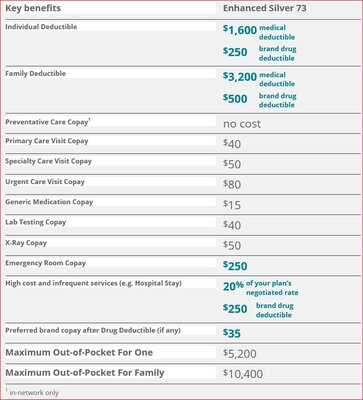

The most recent study of Obamacare ACA-compliant plan related costs to consumers, indicates that Americans are now getting hammered exceptionally hard by Out-of-Pocket costs related to their health insurance.

Excerpt:

"Only three in five households have enough liquid assets to meet a deductible of either $1,200 per individual or $2,400 per family, according to the Kaiser Family Foundation study. Only about half of U.S. households had enough such assets to cover higher deductibles of $2,500 per individual or $5,500 per family.

The situation only gets worse for households when considering their exposure to total out-of-pocket costs. Just 48 percent of households have enough liquid assets to cover what were considered to be the mid-range of such out-of-pocket health cost limits: $3,000 per individual and $6,000 per family, according to the Kaiser study.

Just 37 percent can meet the higher range of such costs, or $6,000 per individual and $12,000 per family, the study found."

Source: Even with insurance, Americans have trouble paying medical bills

Note: The above numbers don't take into account the potential for thousands of dollars OOP for medications.

ac

The most recent study of Obamacare ACA-compliant plan related costs to consumers, indicates that Americans are now getting hammered exceptionally hard by Out-of-Pocket costs related to their health insurance.

Excerpt:

"Only three in five households have enough liquid assets to meet a deductible of either $1,200 per individual or $2,400 per family, according to the Kaiser Family Foundation study. Only about half of U.S. households had enough such assets to cover higher deductibles of $2,500 per individual or $5,500 per family.

The situation only gets worse for households when considering their exposure to total out-of-pocket costs. Just 48 percent of households have enough liquid assets to cover what were considered to be the mid-range of such out-of-pocket health cost limits: $3,000 per individual and $6,000 per family, according to the Kaiser study.

Just 37 percent can meet the higher range of such costs, or $6,000 per individual and $12,000 per family, the study found."

Source: Even with insurance, Americans have trouble paying medical bills

Note: The above numbers don't take into account the potential for thousands of dollars OOP for medications.

ac