LaughDontCry

New Member

- 13

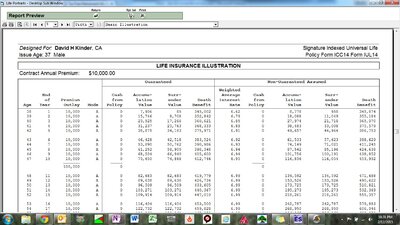

I have been trying to get to the bottom of (or the truth) about recommending to my clients the tax free retirement strategy using Patrick Kelly or the RAFT vs what Pan Yellen and Nash propose as ONLY viable with Whole Life and PUA's and some term.

I hate the arguing and bickering, that only One of these is truly safe and dependable.

The WLife idea I am more attracted to, mainly cause I prefer Mutual Companies, but my upline insists that IUL can be trusted and the results are much better.

The illustrations seem to agree.

Can anyone or has anyone researched this and can point me in the right direction?

Please stay neutral.....I realize thats asking alot.

I really need facts!

Thanks

I hate the arguing and bickering, that only One of these is truly safe and dependable.

The WLife idea I am more attracted to, mainly cause I prefer Mutual Companies, but my upline insists that IUL can be trusted and the results are much better.

The illustrations seem to agree.

Can anyone or has anyone researched this and can point me in the right direction?

Please stay neutral.....I realize thats asking alot.

I really need facts!

Thanks