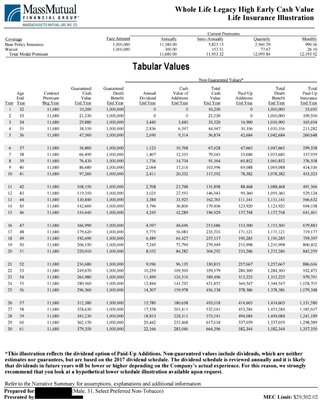

I'm working with an agent and interested in HECV policies. The sample policy he generated for me has a $11,380 base premium and $300 addt'l for the waiver (see attached for a redacted copy, 31 yo, select preferred non-tobacco, $1 MM guaranteed death benefit, premiums stop at age 85)

The policy also shows a MEC Limit of $29,500 in the bottom right hand corner. It's unclear to me what that means and wanted to get some clarification from the gurus on this forum as I don't really understand the explanation provided.

Does that mean I can directly provide $17,800 in additional premium each year to purchase paid up additions? Or directly provide at most $29,500 in additional premiums in every 7 year window?

Also, are paid up additions riders available on HECV policies?

The policy also shows a MEC Limit of $29,500 in the bottom right hand corner. It's unclear to me what that means and wanted to get some clarification from the gurus on this forum as I don't really understand the explanation provided.

Does that mean I can directly provide $17,800 in additional premium each year to purchase paid up additions? Or directly provide at most $29,500 in additional premiums in every 7 year window?

Also, are paid up additions riders available on HECV policies?