David88k

New Member

- 16

I got a call from a 33 year old female looking to get insured and I just wanted to make sure to give her the best option possible. Im new to the insurance business so I want to make sure that I dont mess anything up. I have an indy contract under a GA with MoO and Trans and I wanted to see what the best option would be for her.

She's interested in MoO and she was asking about a 100k term but I showed her how affordable it actually is, if she qualifies for fully underwritten but Im just not sure if she will. She gets state disability and she has bipolar disorder, her height and weight are about 245lbs around 5 5". Would she qualify for fully underwritten standard? or should I just go straight to simplified issue?

She has 5 kids ages 19,18,16,14,12 and I feel really bad about her situation and I want to help her out as much as I can.

I quoted her 300k for 30 year term which came out to $37.76 and I also quoted her 100K GUL to age 90 which was $46.84

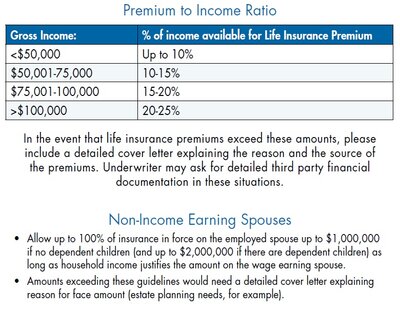

Her total premium came out to $84.60 and she agreed to that. I filed out the application and went back to the office and my GA told me that because of her income (around 11k) she can only qualify for about 100,000k. Now lets say I offer her Simplified issue GUL for 100k can I also offer her another 100k in term life through Transamerica? And again would she qualify for Fully Underwritten or should I just not waste my time and go straight to SI?

I am trying to put together the best solution for her and I also want to make sure that she doesn't pay more than she has too. Im willing to go the extra mile for my customers and thats never been a problem but I want to make sure that I am going in the right direction before I do anything else.

Any help would be greatly appreciated.

She's interested in MoO and she was asking about a 100k term but I showed her how affordable it actually is, if she qualifies for fully underwritten but Im just not sure if she will. She gets state disability and she has bipolar disorder, her height and weight are about 245lbs around 5 5". Would she qualify for fully underwritten standard? or should I just go straight to simplified issue?

She has 5 kids ages 19,18,16,14,12 and I feel really bad about her situation and I want to help her out as much as I can.

I quoted her 300k for 30 year term which came out to $37.76 and I also quoted her 100K GUL to age 90 which was $46.84

Her total premium came out to $84.60 and she agreed to that. I filed out the application and went back to the office and my GA told me that because of her income (around 11k) she can only qualify for about 100,000k. Now lets say I offer her Simplified issue GUL for 100k can I also offer her another 100k in term life through Transamerica? And again would she qualify for Fully Underwritten or should I just not waste my time and go straight to SI?

I am trying to put together the best solution for her and I also want to make sure that she doesn't pay more than she has too. Im willing to go the extra mile for my customers and thats never been a problem but I want to make sure that I am going in the right direction before I do anything else.

Any help would be greatly appreciated.