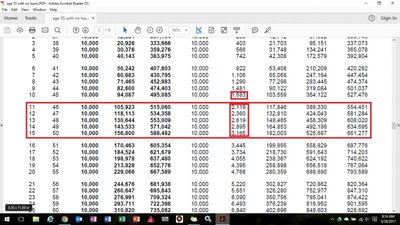

- 11,273

In making the comparison of cash flow, I see the difference of direct recognition of dividends because dividends are reduced when a loan is taken from an Assurity policy.

Compare the dividend columns and you'll see that, and you'll also notice that I mentioned that in my blog post:

Compare the dividend columns and you'll see that, and you'll also notice that I mentioned that in my blog post:

Year 11: Is the year we take out the loan.

- Notice the lower dividend compared in year 10 vs year 11, as this is a direct recognition policy. That means that when dividends are paid, it takes the outstanding loan into account as to how much of a dividend to pay.

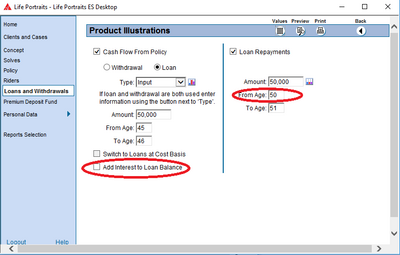

- The loan interest per year is calculated to be $2,115 each year based on current interest and loan rates. (Notice that the payment per year increased from $10,000 to $12,115 to account for the loan interest.)