My sister is 65 and she was offered by her bank manager a "Financed single premium Universal life insurance policy", naturally the bank manager is only offering financing for the single premium because he is well aware that she has sufficient collateral. The manager introduced my sister to a broker who requested to do a thorough medical. Although she has not seen the results of her medical examination she was told the results were quite good, and well in line with the expected 65 year old lady. The indication the broker gave her was that the single time premium will be approximately 49% of the policy value and she can decide the policy value to be either high or low as she prefers (i.e. if she decides to take the 1m policy, the premium would be 490k etc....) With the premium being 49% and additionally the cost of financing being 1% p.a. of the fully paid premium it seems her siblings may only end up with maximum 30%-35% left from the final insurance payout. I can not help but think that the bank or the bank manager and the broker are making a substantial amount out of this deal which is why they are promoting it so aggressively to multiple banking clients.

The manager keeps telling her that the insurance cash value will increase by minimum of 2% every year and it will take my sister 7 years to breakeven with the premium and at any point she can draw part or all of the cash value but if she draws money from the cash value, her final policy value will be reduced by the same amount. The bank manager was telling her that the main benefit is that the she does not have to pay the premium from her pocket now and it would be automatically deducted from the final payout, all she has to pay is the cost of financing the premium.

The broker tried to scare her by saying that no one apart from them would be willing to give her high value life insurance at this age. Is this true?

For a person who is paying the full premium upfront should the premium be 49% of the policy value? What should the premium be for a 65 year old lady with good health.

Please can you give your expert guidance on how she can avoid the bank or the broker taking advantage of this situation and how she can get a fair policy without having to daily go through heavy and thorough medical examination for each and every broker/insurance company.

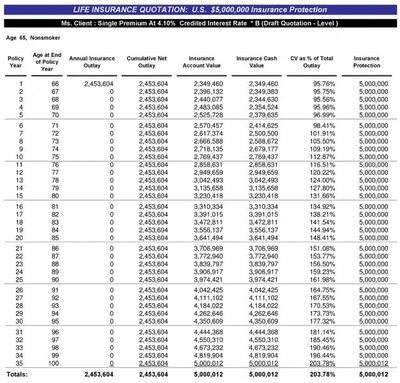

I have attached the example they used to demonstrate how the policy works with a cash value increasing at 4.1%.

Please guide and give as many tips as possible.

The manager keeps telling her that the insurance cash value will increase by minimum of 2% every year and it will take my sister 7 years to breakeven with the premium and at any point she can draw part or all of the cash value but if she draws money from the cash value, her final policy value will be reduced by the same amount. The bank manager was telling her that the main benefit is that the she does not have to pay the premium from her pocket now and it would be automatically deducted from the final payout, all she has to pay is the cost of financing the premium.

The broker tried to scare her by saying that no one apart from them would be willing to give her high value life insurance at this age. Is this true?

For a person who is paying the full premium upfront should the premium be 49% of the policy value? What should the premium be for a 65 year old lady with good health.

Please can you give your expert guidance on how she can avoid the bank or the broker taking advantage of this situation and how she can get a fair policy without having to daily go through heavy and thorough medical examination for each and every broker/insurance company.

I have attached the example they used to demonstrate how the policy works with a cash value increasing at 4.1%.

Please guide and give as many tips as possible.