- 1,405

I don't think a need for permanent insurance necessarily stops at retirement.

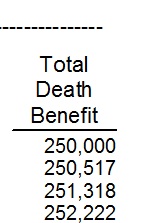

That's why I have some permanent insurance, to pay a death benefit WHEN I die.

But how could I possibly keep paying the premiums if I was not adequately prepared for retirement?

----------

Actually, that is exactly how life insurance companies pay commissions, based on Death Benefit.

News to me.

35 years in the business and I learned something brand new; or did I?