- 5,949

And if they can find one that gives back some of the Part B premium, it's like they're being paid to be a member! Winner, winner, chicken dinner.

Unless they wind up in the hospital for a week with no wrap around . . .

----------

Agent told me today she never sales MS because a $0 MAPD is a much better deal for the client.........I didn't bother with any follow up questions, but it's the 2nd time in a month I heard that comment made.........thoughts?

Only if they can't afford a Med Sup in my opinion . . .

----------

Or a $0 MAPD plan that gives back $75/mo with a strong network (as most have around here) and has $0 copays for Doctors, Specialists, Outpatient hospital, Inpatient hospital, and a $50 copay for ER. AND has a MOOP of $3,400 (and this is NOT a medi/medi plan)

Pretty strong. Who is that with? In Duval County by chance?

----------

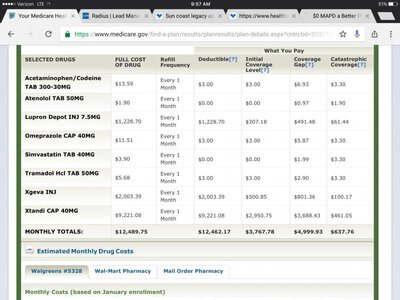

Out of curiosity, on Medicare.gov, I clicked health plans with drug coverage. 3 of his brand name drugs on Part D only, were tier 2 generics with AETNA PPO in my area. So they are like $5 and to top it off, they are $5 in the donut hole!

I learned that yesterday about a few MAPD's - their Tier 1 and 2 are $2 and $5 all the way through . . .

But dang - the hospital was $285 for first 7 days . . .

----------

Like others have said, it's good to offer both.

Saturday I sold two Plan F's. I recommended G or N, but they were the type where "its worth it for convenience" even though logic says dont buy F.

Today a $0 MAPD. He would have loved a Supp but at 89 yrs old we were limited. And, frankly, we have some really good 0 premium PPO's in central OH.

All 3 clients happy.

That is awesome. I envision most clients cross sold from FE direct mail leads will be MA / MAPD writes and most clients from online marketing sources will be Med Sup. Just based on the data targeted . . .

Walking away from MAPD is walking away from a lot of money once you have a good sized book of business.

Yep. $429 or $222 initial per write + $222 annual renewal for life of the deal . . . That is a lot of money . . . 200 renewals is waking up every month to about 37 $100 bills . . .