AnnuityGuy63

Expert

- 53

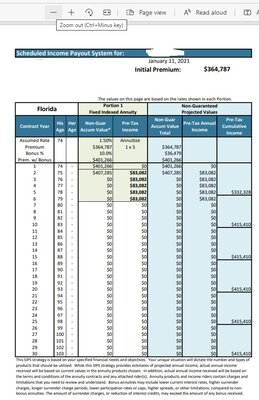

Does anyone know of anything called a 1 x 5 using an FIA?

Atlantic coast uses their GIA with the accumulation rider to defer income the 1st year and then you can annuitize over 5 years to fund an IUL or for what ever reason, I believe this is only available in Florida. and it works better than an SPDA or MYGA since you are actually annuitizing over a 5 year period.

With no fee's and the 10% bonus plus the 1.% interest it's basically giving the client just under 3% on their money and it funds the product.

I used Atlantic Coast but THEY SUCK, try to make a withdrawal and they sit on your clients money for going on 75 days now, with excuses of still going through processing, compliance, approval- telling me they mailed out the clients funds with a tracking number that shows still waiting to be mailed and not really leaving the facility... blah blah blah. Unable to get Kip Nielsen on the phone over their to get it moving. Already filed a complaint with the state against them. I have moved almost all of my clients away from them. When a client tells me they have an annuity with them it's the easiest contract to replace as all I have to do is call them on speaker and just leave it for the length of the appointment.. after 15 or 20 minutes the client is convinced and fearful but I let them know it will take approx 8 weeks to complete.

Anyway.

I refuse to use ACL anymore for anything but am looking to replace them for this product..... anyone anyone?

Atlantic coast uses their GIA with the accumulation rider to defer income the 1st year and then you can annuitize over 5 years to fund an IUL or for what ever reason, I believe this is only available in Florida. and it works better than an SPDA or MYGA since you are actually annuitizing over a 5 year period.

With no fee's and the 10% bonus plus the 1.% interest it's basically giving the client just under 3% on their money and it funds the product.

I used Atlantic Coast but THEY SUCK, try to make a withdrawal and they sit on your clients money for going on 75 days now, with excuses of still going through processing, compliance, approval- telling me they mailed out the clients funds with a tracking number that shows still waiting to be mailed and not really leaving the facility... blah blah blah. Unable to get Kip Nielsen on the phone over their to get it moving. Already filed a complaint with the state against them. I have moved almost all of my clients away from them. When a client tells me they have an annuity with them it's the easiest contract to replace as all I have to do is call them on speaker and just leave it for the length of the appointment.. after 15 or 20 minutes the client is convinced and fearful but I let them know it will take approx 8 weeks to complete.

Anyway.

I refuse to use ACL anymore for anything but am looking to replace them for this product..... anyone anyone?

no wonder we have the issues we are having!

no wonder we have the issues we are having!