- 10,330

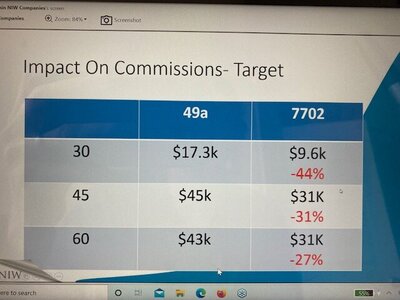

Why is there no threads about 7702. This is the MAIN TOPIC of the last two months. Every webinar is talking about band-aids companies are using or starting fresh products coming out in October. I see that starting in JULY commissions will be slashed. I also have seen an average amount of risk (pure insurance) being slashed up to 44%!!! 44% lower initial insurance for 30 y/o, 30% lower for 45 y/o, 27% less initial life insurance for 60 year olds. Performance will increase, yet the insurance company must make their profit as well.

What is your experience with the company you are working? Are you finding the same results? Which companies have bandaids and which have new products coming out and when?

Thank you all for your insight,

KozyInsure

The truth is that no body really knows exactly how this is going to shake out.

I just spoke to the regional director of a major mutual the other day.... they had extremely limited info on how IUL and WL will be impacted. They also said most carriers are still waiting on further guidance from the NAIC/IRS/etc. before announcing how new sales will be impacted.

Considering that this is an effort to boost profits for carriers by utilizing a lower guaranteed interest rate, I dont see how that correlates to lower commissions. If anything, it should keep them steady or increase comp slightly.