Sup yall. I have a prospect who just turned 65 and retired, and is getting insurance through wife’s work. She is retiring soon and she is turning 65. They want supplements.

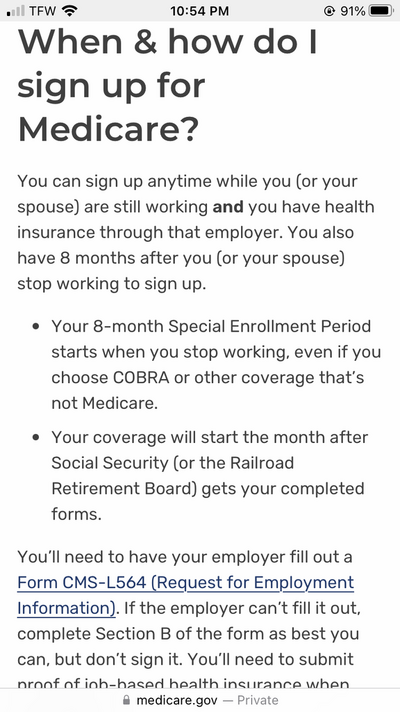

Can both sign up for part A only, then both get a part D plan, and wait 5 months with COBRA coverage then sign up for Part B before the 8 month special election period is over? That way they eliminate any penalties, save Part B premium for 5 months, and can get a supplement before the 6 month period is over. Would this work?

Can both sign up for part A only, then both get a part D plan, and wait 5 months with COBRA coverage then sign up for Part B before the 8 month special election period is over? That way they eliminate any penalties, save Part B premium for 5 months, and can get a supplement before the 6 month period is over. Would this work?