Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Colorado Bankers (CB Life)...

- Thread starter FETalk

- Start date

2023 1099s don't even have to be mailed until tomorrow.I’ve contacted my senator, said sorry for your loss, we cannot or will not help in this situation … have received multiple 1099’s so far….but nothing from CBL …justice dept is our best hope in my opinion

You can do your own calculations and pay tax beyond what the 1099 says if you think they're wrong.

I wouldn't trust this company at all at this point but I would just pay the tax based on what you assume it should be (which should be any gains above your initial premium that were distributed are taxed at your ordinary income rate).

Also, if your original deposit was a 1035 exchange, that basis carries.

Qualified annuities are all taxed as ordinary income with no relation to basis.

From Turbo Tax

If you have a 1099-R but there are errors on the form, make sure the following is correct:

- Your Social Security number

- The amount of income you received

- The amount of taxes the payer withheld from your income

If any of these items is incorrect, inform the company that issued your Form 1099-R and ask for a corrected copy before you file your return.

If other information is incorrect, you should still ask the payer to correct the information and send you a new copy, but you won't need the copy before you file your return.

If you don’t receive a form after requesting one, or your plan administrator won’t send you a corrected copy, you can still file your return by completing a substitute Form 1099-R.

End of Turbo Tax statement.

Because the 1099's will probably be wrong, based on prior history, I would never have taxes withheld, because who knows if they will ever send the money to the IRS.

If you have a 1099-R but there are errors on the form, make sure the following is correct:

- Your Social Security number

- The amount of income you received

- The amount of taxes the payer withheld from your income

If any of these items is incorrect, inform the company that issued your Form 1099-R and ask for a corrected copy before you file your return.

If other information is incorrect, you should still ask the payer to correct the information and send you a new copy, but you won't need the copy before you file your return.

If you don’t receive a form after requesting one, or your plan administrator won’t send you a corrected copy, you can still file your return by completing a substitute Form 1099-R.

End of Turbo Tax statement.

Because the 1099's will probably be wrong, based on prior history, I would never have taxes withheld, because who knows if they will ever send the money to the IRS.

From Turbo Tax on substitute 1099-R

If your plan administrator doesn't give you Form 1099-R for 2023 (or the one you receive is wrong and your plan administrator refuses to correct it), do your best to obtain the form or correction before completing a substitute on Form 4852.

You'll be required to:

- Describe your communications with the plan administrator in your attempt to get the form, and

- Attest to the IRS that you were unable to obtain it

Complete a Form 1099-R as if you actually received the correct form. Enter as much info about the payer as you can, including name, address, and the amounts for 2023. Then complete the info for the substitute form—we’ll help you out with this.

If your plan administrator doesn't give you Form 1099-R for 2023 (or the one you receive is wrong and your plan administrator refuses to correct it), do your best to obtain the form or correction before completing a substitute on Form 4852.

You'll be required to:

- Describe your communications with the plan administrator in your attempt to get the form, and

- Attest to the IRS that you were unable to obtain it

Complete a Form 1099-R as if you actually received the correct form. Enter as much info about the payer as you can, including name, address, and the amounts for 2023. Then complete the info for the substitute form—we’ll help you out with this.

Yeah, no way I'd file my own taxes with all of that going on.

I'd want to have someone (CPA/EA) who could represent me for an audit.

I'd want to have someone (CPA/EA) who could represent me for an audit.

Phyllis Christos

Expert

- 45

Received our 1099 yesterday and the taxable amount is correct assuming they didn't still have 350 grand of our money....

How can we be taxed on money that we don't have and may never get back??

Sure -- they are taxing us on the interest amount -- I get that...and again the amount is correct...but this whole thing is just continuing to make us sick because they STILL have most of our initial investment....paying us 1% interest on it... which is another blow. WTF??

How can we be taxed on money that we don't have and may never get back??

Sure -- they are taxing us on the interest amount -- I get that...and again the amount is correct...but this whole thing is just continuing to make us sick because they STILL have most of our initial investment....paying us 1% interest on it... which is another blow. WTF??

- 4,608

I totally agree! The court or the rehabilitator should be involved to put in place some sort of exemption for us to not have to pay taxes on this yet. We should look into contacting the rehabilitator to request an exemption with the IRS for this unique situation.

Agree personally, but I can see why it doesnt happen. There are lots of investments where people are taxed along the way when receiving interest or dividends only to later have part or all of their principal investment lost.

IE: Someone buys a dividend paying stock. They are taxed each year on the Dividends, but that company could go bankrupt or the underlying stock price drop in half & they lose the value. They cant write off the losses of the principal investment, but could offset it with gains or over a long period of time

A person with a bank account over the FDIC limit could get 1099 for decades for taxable interest, then when bank fails, they may only get a fraction of the original principal back

I could sell my house on Land contract over 20 years, paying interest & even capital gains each year as I receive payments only to have the buyer default & devalue the property from lack of maintenance, damage, etc.

Plus, if these are Qualified Traditional CBL annuites, the entire distributions are taxable as there is no cost basis/principal in the account. Roth IRA wont have any reported as taxable on a current 1099, so really talking only about the non-qualified versions where owners will only find out what their taxable gains were once the entire mess is finally settled.

But, I agree, there should be an offset when that is figured out in the end against interest that was previously reported for those that are above their states guaranty association & receive back less than their individual total cost basis

So, as much as I would support it, I dont see it happening with IRS. after it is resolved & losses figured out, you will have to see if there is any path to deduct losses somehow on taxes or merge it with another annuity that has taxable gains to wash them together.

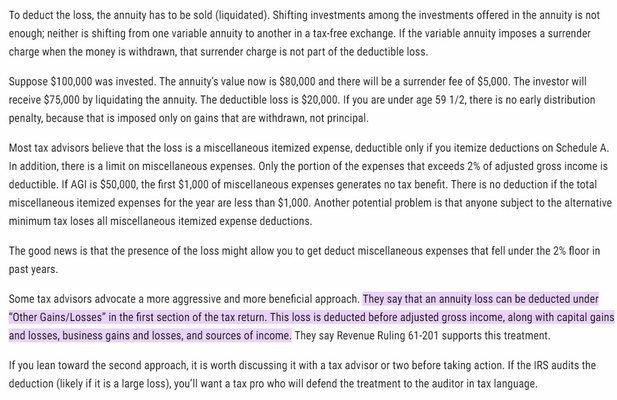

talk to a CPA when this is all done. If you have losses in the NQ Annuity, there are areas of the tax return that some CPAs use for either deducting losses on NQ Annuity when cashed in/surrendered as itemized deductions & some more aggressive CPAs use some revenue rulings to deduct it directly against income rather than limited itemized deductions (more common on Variable Annuities that are in the stock market)

Last edited:

Phyllis Christos

Expert

- 45

Interesting, thanks. Ours is Non-qualified. Your points are all well taken.

I received my 1099 yesterday and it is close to what I expected. Unlike other interest statements where you can just add up the interest credited to your account during the year to get the final number, that didn't work here. Kroll doesn't make that easy to do. They told me they would make 1% interest payments monthly but they only pay every other month. Upon my inquiry I was told that they only make an interest payment if it is at least $50. From my original paperwork with CBL I knew exactly how much interest I was due on my maturity date in May 2023. Using that number and actual interest payments made to me in 2023 leads to a number nearly $100 less than my 1099 form claims I received. I have to accept that their calculation is correct although I have my doubts.

Similar threads

- Replies

- 10

- Views

- 1K

- Replies

- 45

- Views

- 2K