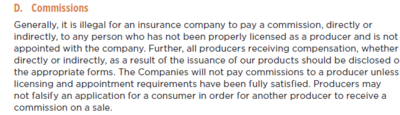

I have a friend that's a newly licensed life agent in Texas. Someone she knows reached out to her to get a life insurance policy but she lives in Florida. I'm licensed in Florida so she asked if I could help her and then we can split the commission or something.

We are both appointed with the carrier so that's not a problem, but I was wondering if in order for me to split the commission at the carrier level does she have to be licensed and appointed IN Florida? or is it okay as long as she's licensed and appointed with the carrier.

We are both appointed with the carrier so that's not a problem, but I was wondering if in order for me to split the commission at the carrier level does she have to be licensed and appointed IN Florida? or is it okay as long as she's licensed and appointed with the carrier.