- 4,576

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Death Claim Concerns

- Thread starter titeye

- Start date

- Thread starter

- #32

Update:

I'm pulling LBL off the field again and sitting LBL them back on the bench, until further notice. Instead of sending a letter to the beneficiary explaining that benefit payable resulted from the policy defaulting to ETI, they send a letter stating that the qualifying event occurred during policy year 3; and, the benefit is 100% Return of Premium + 10%.

Since they cc'd me a copy of the letter that would gone out to the ex-agent, I called them out on it.

The representative kept insisting that the client was in her 3rd year when she died. (Recap: The policy issued Modified on Jan. 28th 2020. The client died May 5th 2023.) After I had to literally ask her to tell me the date when each policy year was completed, she could not deny the fact that the client was 2+ months into her 4th year. Funny thing is, neither would she admit it. After 5 minutes of dead silence, while I surmise she's now recounting on her fingers, she puts me on hold while she talks to a Claims Analyst. She returns and tells me the client must complete their 4th year. SMH!!!

I politely ask her to put the Claims Analyst on the phone. The Claims Analyst emails me 3 documents, prior to speaking with me. One includes the following statement: "Year 4: 100% of the policy's stated Death Benefit"

The second document includes the following statement: "For death during the fourth year, 100% of the sum insured. The third document is a schedule of payments.

In the body of her email, she states, "As you can see in year 3 of the policy, payment s made of $3,452.00. The insured passed May 5, 2023, the policy was issued January 28, 2020, the policy would of paid full benefits on January 28, 2024 as shown in the forth year."

(She was referencing the schedule of payments, but nowhere does it state full benefits paid January 28, 2024.)

Even after me emphasizing the verbiage in her own documents, the Claims Analyst reasserted that the insured has to "COMPLETE" the 4th year, for full benefits to be paid. Not only did I explain to her that completing the 4th year would be a 4-year waiting period, consequently her logic would indicate full benefits would not be paid until this client's 5th policy year. All of which contradicts what is in writing. I asked if she agreed that there is a difference between the 2 words, completed and during. She agreed.

I explained that none of her documents include the word "completed" and asked if she had anything in writing that specifically contained the use of that word. She did not, of course.

These representatives are either making up stuff as they go along, or the higher ups are discouraging their subordinates from seeking help from them. Too often, lower level employees will tell you anything, even when you show them what they are saying doesn't make sense. Even still, they remain defiant and reluctant to admit it doesn't make sense to them either. This reminds me of a discussion we had here recently on why many people believe insurance and/or insurance companies are a scam. When you hire people who are misinforming their clients, what other conclusion can they form?

Sorry for the long essay.

I'm pulling LBL off the field again and sitting LBL them back on the bench, until further notice. Instead of sending a letter to the beneficiary explaining that benefit payable resulted from the policy defaulting to ETI, they send a letter stating that the qualifying event occurred during policy year 3; and, the benefit is 100% Return of Premium + 10%.

Since they cc'd me a copy of the letter that would gone out to the ex-agent, I called them out on it.

The representative kept insisting that the client was in her 3rd year when she died. (Recap: The policy issued Modified on Jan. 28th 2020. The client died May 5th 2023.) After I had to literally ask her to tell me the date when each policy year was completed, she could not deny the fact that the client was 2+ months into her 4th year. Funny thing is, neither would she admit it. After 5 minutes of dead silence, while I surmise she's now recounting on her fingers, she puts me on hold while she talks to a Claims Analyst. She returns and tells me the client must complete their 4th year. SMH!!!

I politely ask her to put the Claims Analyst on the phone. The Claims Analyst emails me 3 documents, prior to speaking with me. One includes the following statement: "Year 4: 100% of the policy's stated Death Benefit"

The second document includes the following statement: "For death during the fourth year, 100% of the sum insured. The third document is a schedule of payments.

In the body of her email, she states, "As you can see in year 3 of the policy, payment s made of $3,452.00. The insured passed May 5, 2023, the policy was issued January 28, 2020, the policy would of paid full benefits on January 28, 2024 as shown in the forth year."

(She was referencing the schedule of payments, but nowhere does it state full benefits paid January 28, 2024.)

Even after me emphasizing the verbiage in her own documents, the Claims Analyst reasserted that the insured has to "COMPLETE" the 4th year, for full benefits to be paid. Not only did I explain to her that completing the 4th year would be a 4-year waiting period, consequently her logic would indicate full benefits would not be paid until this client's 5th policy year. All of which contradicts what is in writing. I asked if she agreed that there is a difference between the 2 words, completed and during. She agreed.

I explained that none of her documents include the word "completed" and asked if she had anything in writing that specifically contained the use of that word. She did not, of course.

These representatives are either making up stuff as they go along, or the higher ups are discouraging their subordinates from seeking help from them. Too often, lower level employees will tell you anything, even when you show them what they are saying doesn't make sense. Even still, they remain defiant and reluctant to admit it doesn't make sense to them either. This reminds me of a discussion we had here recently on why many people believe insurance and/or insurance companies are a scam. When you hire people who are misinforming their clients, what other conclusion can they form?

Sorry for the long essay.

Last edited:

- 18,989

Update:

I'm pulling LBL off the field again and sitting LBL them back on the bench, until further notice. Instead of sending a letter to the beneficiary explaining that benefit payable resulted from the policy defaulting to ETI, they send a letter stating that the qualifying event occurred during policy year 3; and, the benefit is 100% Return of Premium + 10%.

Since they cc'd me a copy of the letter that would gone out to the ex-agent, I called them out on it.

The representative kept insisting that the client was in her 3rd year when she died. (Recap: The policy issued Modified on Jan. 28th 2020. The client died May 5th 2023.) After I had to literally ask her to tell me the date when each policy year was completed, she could not deny the fact that the client was 2+ months into her 4th year. Funny thing is, neither would she admit it. After 5 minutes of dead silence, while I surmise she's now recounting on her fingers, she puts me on hold while she talks to a Claims Analyst. She returns and tells me the client must complete their 4th year. SMH!!!

I politely ask her to put the Claims Analyst on the phone. The Claims Analyst emails me 3 documents, prior to speaking with me. One includes the following statement: "Year 4: 100% of the policy's stated Death Benefit"

The second document includes the following statement: "For death during the fourth year, 100% of the sum insured. The third document is a schedule of payments.

In the body of her email, she states, "As you can see in year 3 of the policy, payment s made of $3,452.00. The insured passed May 5, 2023, the policy was issued January 28, 2020, the policy would of paid full benefits on January 28, 2024 as shown in the forth year." (She was referencing the schedule of payments.)

Even after me emphasizing the verbiage in her own documents, the Claims Analyst reasserted that the insured has to "COMPLETE" the 4th year, for full benefits to be paid. Not only did I explain to her that completing the 4th year would be a 4-year waiting period, consequently her logic would indicate full benefits would not be paid until this client's 5th policy year. All of which contradicts what is in writing. I asked if she agreed that there is a difference between the 2 words, completed and during. She agreed.

I explained that none of her documents include the word "completed" and asked if she had anything in writing that specifically contained the use of that word. She did not, of course.

These representatives are either making up stuff as they go along, or the higher ups are discouraging their subordinates from seeking help from them. Too often, lower level employees will tell you anything, even when you show them what they are saying doesn't make sense. Even still, they remain defiant and reluctant to admit it doesn't make sense to them either. This reminds me of a discussion we had here recently on why many people believe insurance and/or insurance companies are a scam. When you hire people who are misinforming their clients, what other conclusion can they form?

Sorry for the long essay.

Time for the DOI to get involved.

- Thread starter

- #34

I was thinking the same thing. The only part that concerns me is that LBL could be right, but for the wrong reason. ETI is more logical, but their representatives are sending out incorrect info to the beneficiary. I am going to ask for a copy of the policy.Time for the DOI to get involved.

- 18,989

I was thinking the same thing. The only part that concerns me is that LBL could be right, but for the wrong reason. ETI is more logical, but their representatives are sending out incorrect info to the beneficiary. I am going to ask for a copy of the policy.

The documents you have show the full face should be paid. File a complaint with the DOI over the beneficiaries signature and send those supporting documents.

If they are right and there’s a loophole make them prove it.

- 4,576

Recap: The policy issued Modified on Jan. 28th 2020. The client died May 5th 2023.)

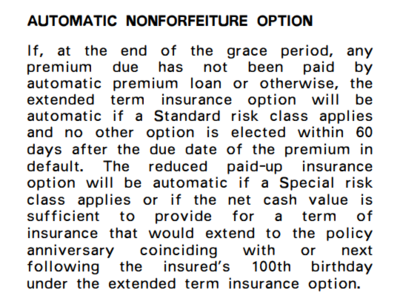

Did client make a premium payment after 1/28/2023? If not, the policy likely had a grace period of 30 days to make payment & possibly another extra 30 day payment window where there was no coverage if she died during days 31-60 but she could still pay the back premium to maintain coverage. Policy could lapse on 3/27/23 for no payment back up 1/27/23 when the last payment provided coverage until

Similar threads

- Replies

- 3

- Views

- 649

- Replies

- 13

- Views

- 1K

- Replies

- 33

- Views

- 3K