RickyG

Expert

- 63

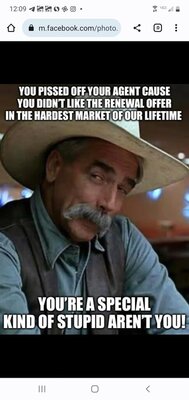

I was just wondering if anyone else experiences this with clients.

Client- I just got a quote from GEICO thats (for example) 70.00 less per month! Can you match that? Why am I being ripped off??

Us- Well Mr/Ms X, you have 3 recent claims, a speeding ticket and 1 AFA last year. What this tells me is GEICO has not run their underwriting reports and you WILL get that priced raised significantly at renewal (if not before) and then we won't be able to get the price you pay now anywhere as it will be much higher.

Client- F you I cancel

Fast Forward 6 months:

Client- My insurance went up 200 a month! GEICO screwed me! Can we get the (insert carrier name) policy back going?

Us- well after running the numbers we can get it 50.00 lower than your current GEICO

Client- WTF!? Thats still over 100 more than I originally had!!

Us: Sorry? Not sure what else we can do

Client- F you I'm calling a real agency

Client- I just got a quote from GEICO thats (for example) 70.00 less per month! Can you match that? Why am I being ripped off??

Us- Well Mr/Ms X, you have 3 recent claims, a speeding ticket and 1 AFA last year. What this tells me is GEICO has not run their underwriting reports and you WILL get that priced raised significantly at renewal (if not before) and then we won't be able to get the price you pay now anywhere as it will be much higher.

Client- F you I cancel

Fast Forward 6 months:

Client- My insurance went up 200 a month! GEICO screwed me! Can we get the (insert carrier name) policy back going?

Us- well after running the numbers we can get it 50.00 lower than your current GEICO

Client- WTF!? Thats still over 100 more than I originally had!!

Us: Sorry? Not sure what else we can do

Client- F you I'm calling a real agency