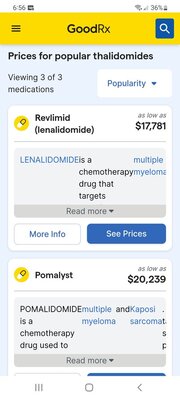

Rx changes/additions mid year that have been staggering. That's my biggest concern for consumers who have High Incomes and are considering foregoing PDP.

More proof that one size does not fit all.

Many folks who only have low cost generics don't need a plan but most (of my clients) will pay $10/mo or so to avoid the LEP. They rarely, if ever, use the plan since discount cards often produce a lower copay.

One of my gripes about PDP is the inability to change plans with an SEP when you get a new Rx for a high priced medication. I understand that the carriers probably designed the plans for THEIR convenience and profit margin, but there are other SEP's, so why not add another to accommodate those whose health changes?

You are saving enough money you could get some dental insurance.

You are saving enough money you could get some dental insurance.