- 11,277

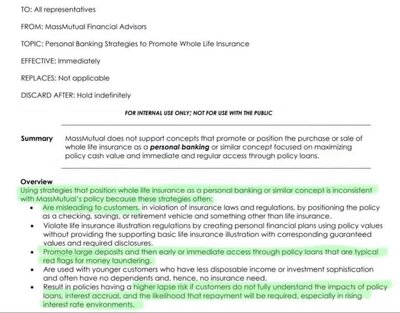

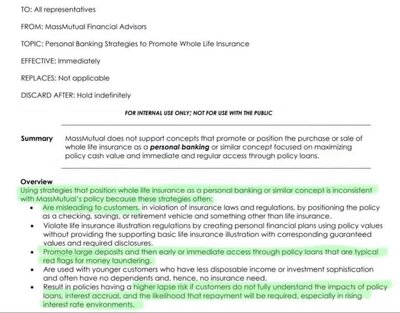

MassMutual sent out (for internal use only; but this is a professional group so this is highly relevant to us) this memo regarding the promotion of "infinite banking" or "personal banking" strategies using life insurance.

This is not just a MassMutual issue. This is an industry issue. I personally know an agent who was terminated from another career contract because he promoted "banking" strategies.

I will share an image and two videos below on this issue along with the memo itself.

Here is the biggest thing: They tend to avoid talking about the fact that it's LIFE INSURANCE. In addition, per the memo, there are other NAIC compliance issues as well in how these are promoted.

If you promote anything to do with IBC or any concept similar, please review the memo and the videos I post in the comments below.

Tom Love expounding on this exact issue:

Listen to John Ocwieja expound on this from early last year:

This is not just a MassMutual issue. This is an industry issue. I personally know an agent who was terminated from another career contract because he promoted "banking" strategies.

I will share an image and two videos below on this issue along with the memo itself.

Here is the biggest thing: They tend to avoid talking about the fact that it's LIFE INSURANCE. In addition, per the memo, there are other NAIC compliance issues as well in how these are promoted.

If you promote anything to do with IBC or any concept similar, please review the memo and the videos I post in the comments below.

Tom Love expounding on this exact issue:

Listen to John Ocwieja expound on this from early last year: