- 10,330

I've always done direct rollovers so the tax wasn't an issue.

But I have taken substantial distributions which were not rolled over into any qualifying account.

In those instances I was able to elect not to have anything withheld. The election, of course, came with the warnings about estimated tax and penalties but that was of no concern to me.

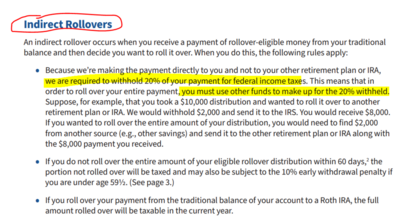

If one is doing an indirect rollover one may have the option of nothing withheld. When the deposit to another qualified account is done within the 60 day limit, it should be an offset with no need for estimated tax and no penalties.

Custodians can put whatever requirements they wish.

The IRS does not require it to be withheld.

But some Custodians do.

It varies. Some allow the opt out and some dont. TSPs have a lot more red tape than other qualified accounts.

Also, distributions are different than closing out the account completely. Custodians sometimes treat it differently regarding the withholding requirements.