- 11,291

https://ttech.infusionsoft.com/app/page/johnolsen

I have registered for this webinar for Thursday, November 7 since we've had a lot of discussion regarding "source of funds" issues. I'm curious to find out what their viewpoints are.

Just thought I'd share.

I have no affiliation with Torrid Technologies or Tim Turner.

Stay out of Jail Card - "Source of Funds Issue" for Fixed Insurance Sales

WHO:

for Financial Advisors, Insurance Agents and Producers selling Fixed Insurance products.

WHAT:

This webinar will discuss the "Source of Funds" Issue in Fixed Insurance Sales

You will learn about:

1. Whether you can have a client purchase an annuity using funds that come from a "securities" investment

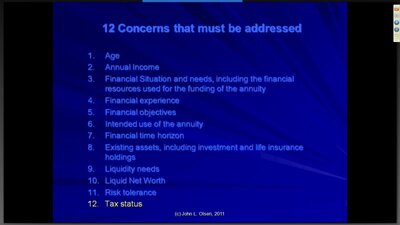

2. What "suitability" rules come into play?

3. What do various states have to say about this issue?

4. Do you have to become an RIA?

GUEST PRESENTER: John L. Olsen, CLU, ChFC, AEP

John is principal of the Olsen Financial Group in Kirkwood Missouri. He has been in the financial industry since 1973 and is a respected speaker, writer, teacher, and consultant. In addition to serving his own clients, John provides case consulting services to attorneys, accountants, insurance agents, and financial advisors, and provides expert witness services in litigation involving annuities and life insurance. He is-co author (with Michael Kitces) of "The Advisor's Guide to Annuities" (National Underwriter Co., 3rd ed.), "Index Annuities: A Suitable Approach" (with Jack Marrion), and author of "Taxation and Suitability of Annuities" (index annuity book) and numerous articles.

PANELIST: Timothy J. Turner, JD

As founder of Torrid Technologies since 1993, Tim Turner has taught thousands of financial advisors and insurance agents how to use his strategies and system to dramatically improve their financial practice and their incomes.

Tim’s software systems have been used by millions of people on websites for Pacific Life, AXA, The Hartford, TIAA-CREF, Franklin-Templeton Funds, JANUS, The MONY Group, MassMutual, and Sun Life. His system is used by financial advisors and reps at major Broker/Dealers like LPL, National Planning Corp, NEXT Financial Group, OneAmerica, TransAmerica Securities, Park Avenue Securities, and Lincoln Financial Advisors.

I have registered for this webinar for Thursday, November 7 since we've had a lot of discussion regarding "source of funds" issues. I'm curious to find out what their viewpoints are.

Just thought I'd share.

I have no affiliation with Torrid Technologies or Tim Turner.