Lloyds of Lubbock

Guru

- 714

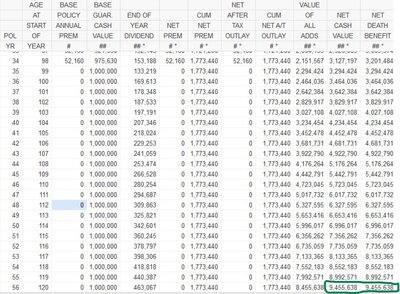

To my mind those policy statements conflict directly with this paragraph in information accompanying the pre-purchase illustration I received:

An illustration is not a contract.

Suggest you call the company

An illustration is not a contract.

Suggest you call the company