roadrunner

Super Genius

- 100

Met with a couple today in TN. She is 59 with no income. He is 66 on Medicare.

He receives 1200 a month for medicare. We had to add him to the application for household income. (other) There is no medicare choice for income. When calculating for a subsidy it is calculating for a plan for a family rather than an individual plan. He does not need a plan.

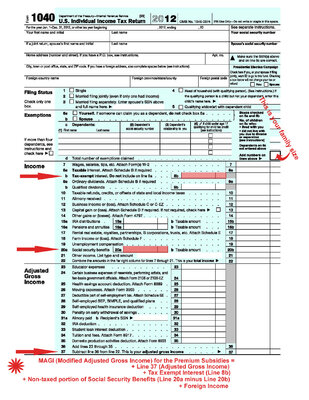

Problem is it is stating they qualify for Medicaid (as a couple) But the income for the household should qualify the spouse without coverage for a subsidy.

Has anyone else ran into this challenge? If so how did you work around this? Or is a household with a medicare eligible person going to be paying for a family plan?

Shouldn't the application pull him back out of the calculation based on his age?

It is NOT her income, it is the husbands, but it is household income. She would prefer not to be on Medicaid , but can not afford a plan without help.

Thanks in advance for any wisdom.

I have called Healthcare.gov - waste of time

BCBST - dunno

Humana- huh????

Cigna- what??

CHA- focusing on group - no help

He receives 1200 a month for medicare. We had to add him to the application for household income. (other) There is no medicare choice for income. When calculating for a subsidy it is calculating for a plan for a family rather than an individual plan. He does not need a plan.

Problem is it is stating they qualify for Medicaid (as a couple) But the income for the household should qualify the spouse without coverage for a subsidy.

Has anyone else ran into this challenge? If so how did you work around this? Or is a household with a medicare eligible person going to be paying for a family plan?

Shouldn't the application pull him back out of the calculation based on his age?

It is NOT her income, it is the husbands, but it is household income. She would prefer not to be on Medicaid , but can not afford a plan without help.

Thanks in advance for any wisdom.

I have called Healthcare.gov - waste of time

BCBST - dunno

Humana- huh????

Cigna- what??

CHA- focusing on group - no help