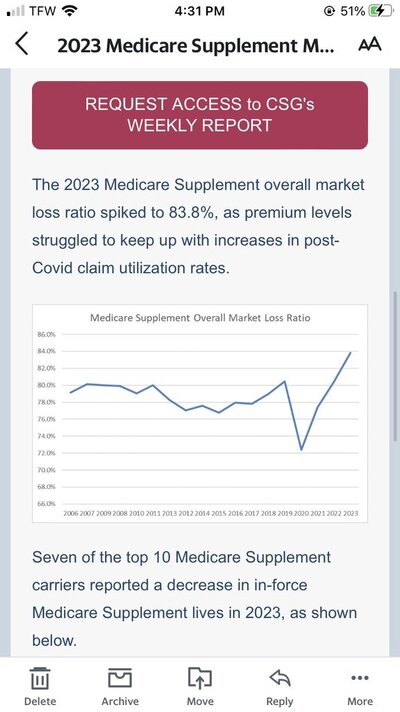

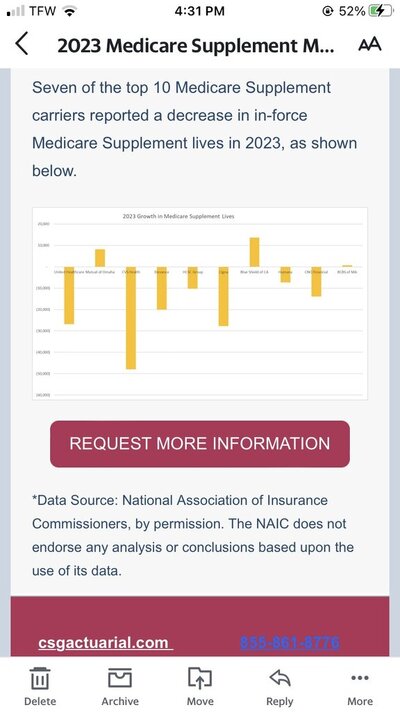

Look at the below graphs . Claims going vertical and total insureds falling .What few talk about is the big % of unfavorable risk ( sick people ) on sups as the healthy rushed to zero premium .

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Med sup claims skying and enrollment falling . Next yr premiums jump big

- Thread starter DonP

- Start date

straightnochaser

Guru

- 558

I shared this earlier as well, the data is concerning for sure.

- Thread starter

- #3

I just read big article . Some analysts believe benefits in mapd could see big reversal in 2025 . There predicting some food cards could be gone , dental having copays , copays on medical rising . We know one thing . The total # of insureds will be the same overall . But the days of sitting on your book and making renewals leaving it alone could be over . An agent might have to move 20-50% of his book in 2025 as plans will differ greatly. I think agents with bigger books better forget growing this aep and be prepared to deal with moving clients all aep

Time to quit!I just read big article . Some analysts believe benefits in mapd could see big reversal in 2025 . There predicting some food cards could be gone , dental having copays , copays on medical rising . We know one thing . The total # of insureds will be the same overall . But the days of sitting on your book and making renewals leaving it alone could be over . An agent might have to move 20-50% of his book in 2025 as plans will differ greatly. I think agents with bigger books better forget growing this aep and be prepared to deal with moving clients all aep

- Thread starter

- #5

I’ll sell my book . 4x commissions ( books now much more valuable with loss of marketing money . Cheaper to buy than grow) That’s over $1 million . I want 100% payment up front structured as a capital gain .Im running 96% persistentcy last 12 months on a 99% mapd book .Time to quit!

- 2,204

Not me. This stuff is getting fun.Time to quit!

If my clients want to move, I'll buy an old, beat up school bus and take them where they want to go.

Lol that's my deal,I’ll sell my book . 4x commissions ( books now much more valuable with loss of marketing money . Cheaper to buy than grow) That’s over $1 million . I want 100% payment up front structured as a capital gain .Im running 96% persistentcy last 12 months on a 99% mapd book .

- Thread starter

- #8

That’s were I got it from !!! 4x baby !!!!Lol that's my deal,

I'm re writing a bunch of med supps this year.

Re-wrote one this morning - I've had her policy since she turned 65 - went from UHC G eff 2/1/20 to new G 5/1/24 - new comp trail starts

Got her husband's - when she had turned 65 in 2020 he wasn't interested in changing. But now he's paying more... Got his Plan F UHC (was over $240/mo) down to new G at $122.

--

Every Monday, I'm sending 40 emails to a segment of my book asking them to call me (or calendly link) for a rate review.

This way - I can work through all 850+ med supps at a reasonable pace spread out over time. And hopefully won't have any asking for price checks or whatever during AEP.

For those willing to learn underwriting - I do think the med supp market has some disruption this year.

Re-wrote one this morning - I've had her policy since she turned 65 - went from UHC G eff 2/1/20 to new G 5/1/24 - new comp trail starts

Got her husband's - when she had turned 65 in 2020 he wasn't interested in changing. But now he's paying more... Got his Plan F UHC (was over $240/mo) down to new G at $122.

--

Every Monday, I'm sending 40 emails to a segment of my book asking them to call me (or calendly link) for a rate review.

This way - I can work through all 850+ med supps at a reasonable pace spread out over time. And hopefully won't have any asking for price checks or whatever during AEP.

For those willing to learn underwriting - I do think the med supp market has some disruption this year.

So, you moved med supp from uhc to uhc and you are getting 6+ yrs of new reset renewals?I'm re writing a bunch of med supps this year.

Re-wrote one this morning - I've had her policy since she turned 65 - went from UHC G eff 2/1/20 to new G 5/1/24 - new comp trail starts

Got her husband's - when she had turned 65 in 2020 he wasn't interested in changing. But now he's paying more... Got his Plan F UHC (was over $240/mo) down to new G at $122.

--

Every Monday, I'm sending 40 emails to a segment of my book asking them to call me (or calendly link) for a rate review.

This way - I can work through all 850+ med supps at a reasonable pace spread out over time. And hopefully won't have any asking for price checks or whatever during AEP.

For those willing to learn underwriting - I do think the med supp market has some disruption this year.

Similar threads

- Replies

- 14

- Views

- 1K

- Replies

- 9

- Views

- 672