Lloyds of Lubbock

Guru

- 714

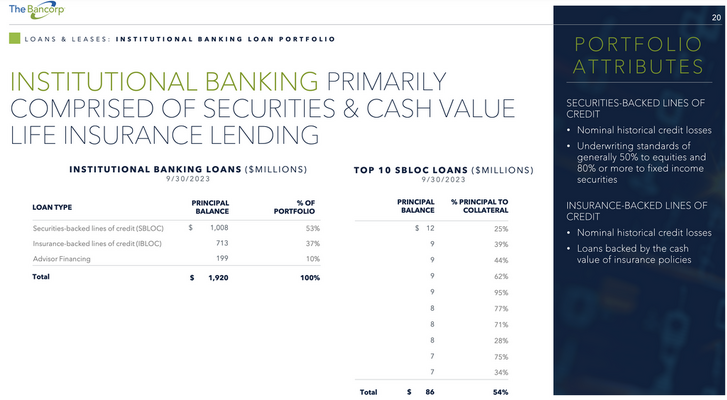

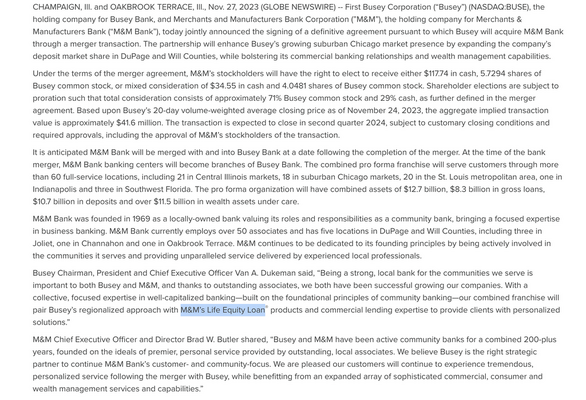

There a numerous companies that take whole life policies.

The interest rates in that market are not competitive.

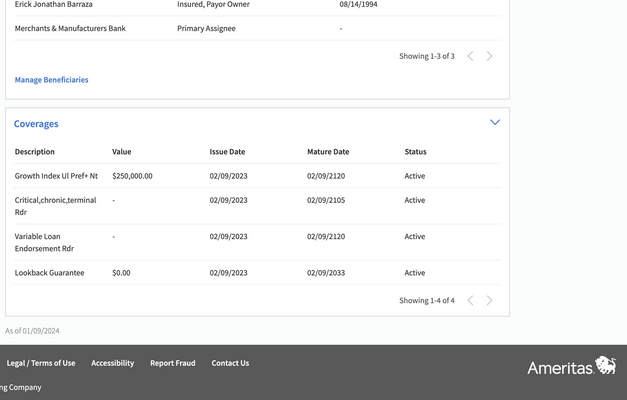

If I had 250k in cash value and wanted a 50k loan a third party lender has to give me a great interest rate to assign them the whole policy.

That market is dead.

Even premium financing many of the brokers I know, when applicable are turning their loans back to the company.

The interest rates in that market are not competitive.

If I had 250k in cash value and wanted a 50k loan a third party lender has to give me a great interest rate to assign them the whole policy.

That market is dead.

Even premium financing many of the brokers I know, when applicable are turning their loans back to the company.