I salute this band of 25 million young traders. There using the power of the net to level the playing field . Wall Street is the most crooked bang of collusion and thieves on earth . There crying because their being killed and somebody pissing on their game . But unfortunately for all a transaction tax on each trade is coming which will destroy day trading . Democrats have been trying to pass for 20 yrs and its coming . The not rising is what’s allowed a ton of co’s to survive the last yr as they issued stock. Look at basically bankrupt American Airlines. There stock skied to $27 last week as the Reddit crowd chased it . After the close yesterday they said they issued $1 bil of stock to raise money. Tsla would basically be Bankrupt but they issued $15 bil of money the last 18 months issuing stock. CO’s are insane not to issue stock like candy to take advantage of the insanity . The fed caused this insanity . They’ve printed $8 tril of money out of them air. There’s more money in money mkt’s than at any time in history . Huge inflation coming as the little guy will be starving.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ex MassMutual advisor behind Reddit GameStop thing

- Thread starter DHK

- Start date

I was talking with a buddy about this the other day and I think you make a great point.I salute this band of 25 million young traders. There using the power of the net to level the playing field . Wall Street is the most crooked bang of collusion and thieves on earth . There crying because their being killed and somebody pissing on their game . But unfortunately for all a transaction tax on each trade is coming which will destroy day trading . Democrats have been trying to pass for 20 yrs and its coming . The not rising is what’s allowed a ton of co’s to survive the last yr as they issued stock. Look at basically bankrupt American Airlines. There stock skied to $27 last week as the Reddit crowd chased it . After the close yesterday they said they issued $1 bil of stock to raise money. Tsla would basically be Bankrupt but they issued $15 bil of money the last 18 months issuing stock. CO’s are insane not to issue stock like candy to take advantage of the insanity . The fed caused this insanity . They’ve printed $8 tril of money out of them air. There’s more money in money mkt’s than at any time in history . Huge inflation coming as the little guy will be starving.

A secondary offering by GameStop nukes both sides and may be what ends up happening.

They raise capital at $100 share....stock price gets crushed, shorts get hammered, nobody wins (except Gamestop...haha).

- 10,363

I was talking with a buddy about this the other day and I think you make a great point.

A secondary offering by GameStop nukes both sides and may be what ends up happening.

They raise capital at $100 share....stock price gets crushed, shorts get hammered, nobody wins (except Gamestop...haha).

I had that thought yesterday. However, who is going to buy it at that price??

Usually institutions commit to take a large amount of offerings. But what institution is going to buy it at that price with the amount of shorts doubling down on it?? The stock is either going to the moon or to $0.50 .

And why do an offering at $100 when the stock is $300... when you could do an offering at $200 when the stock is $600??

Also, those shorts were attempting to basically destroy gamestop stock and bankrupt their company. It might hammer shorts to do an offering, but it wont bankrupt them. They will be back at it again once the frenzy dies down and GME will be in the same position as before, just with some extra cash that might what, a year or two max? So think about it from that standpoint... GME probably wants it to hit $1k as much as every other shareholder.

idk. jmo.

Last edited:

- 10,363

Also, it would have to be a fairly large offering because it has a real small float if I remember right. Which will dilute the stock long term once all this dies down... which depresses the stock price and makes it easier for the shorts to go at them again.

just thinking out loud

just thinking out loud

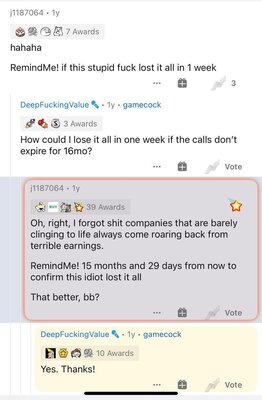

This guy called the GME short squeeze last September. Long read, but he gives very specific reasons as to why it was THE play. Wish I had read this back then. He was recommending the furthest OTM Calls available ($30 January 15, 2021). Those had to be next to nothing as GME was around $7 at the time.

I was a professional day trader for 2 decades. I was one of the original soes bandits in the 1990's with Datek and Harvey Houtkin. Me and a group of guys exploited the soes(small order execution system) In 2000-2003 during the bear mkt.. After the 1987 crash it was put in place to auto execute up to 300 shares auotexecution wether a market maker was there or not. We got with a subsidiary of ameritrade called free trade that charged no commissions . I had 8 monitors with 30 order entry boxes. So if a stock like Ge dropped 30 cents in seconds and turned up I could fire 10 300 share orders in in 3 seconds . Back then market makers would adjust there bids in a 3-5 second window . So if I saw the stock turn up and say trades 5-8 cents above the ask I could get off my 10 300 share orders in 3 second ds and the lagging market maker would have to fill me at the lower bid/ask as he hadn't adjusted his price yet . So as soon as my order filled at the lower price I sold my 10 300 share orders at the 8-10 cent gain . I did that all day long 100's of times a day for 3 yrs. Markjet makers would call ameritrade complaining what we were doing and they'd freeze our account for 30 mins till we said sorry. So the trick was to adjust the share size every trade so they couldn't identify us. 200,197,165 shares etc. It was an incredible 3 years. The key was the volatility . Nowadays the market makers ajust all bid/asks in 1/50th of a second.

- 11,996

tikibarrister

Guru

- 473

I support the proposal that all stocks sold that were held for less than a year should be taxed at 100%.

This kind of speculation does nothing to make the country or the markets better.

This kind of speculation does nothing to make the country or the markets better.

This guy called the GME short squeeze last September. Long read, but he gives very specific reasons as to why it was THE play. Wish I had read this back then. He was recommending the furthest OTM Calls available ($30 January 15, 2021). Those had to be next to nothing as GME was around $7 at the time.

My favorite after DFV posted all of his due diligence on Reddit:

- 10,363

I support the proposal that all stocks sold that were held for less than a year should be taxed at 100%.

This kind of speculation does nothing to make the country or the markets better.

What kind of speculation is that?

Hedge funds shorting 140% of a stocks shares?... which was illegal until hedge funds found a loop hole in the regulations that was not covered....

Or hedge funds illegally shorting a stock in a concerted effort to bankrupt a company who employs 15,000 people.... all for the sake of making a huge profit for their ultra wealthy clients... ??

Because thats what was going on with GME. A few hedge funds created naked shorts against the company in an effort to bankrupt it... causing 15,000 people to lose their job... causing 5,500 landlords to lose rent on GMEs retail locations... at a company that otherwise would not be going bankrupt if not for the naked short selling against it.... just so the hedge funds clients (all people with $1m minimum in liquid investible assets.... most have 100x that) can reap 100%+ gains on their millions of dollars....

Why is it ok for institutions to break the rules but not ok for us citizens to take a financial position against the institutions that are breaking the rules? There is no law against me buying GME stock and holding it and not selling, nor anything unethical about it.

Similar threads

- Replies

- 1

- Views

- 461

- Replies

- 22

- Views

- 3K

- Replies

- 4

- Views

- 439

- Replies

- 4

- Views

- 939