- 4,576

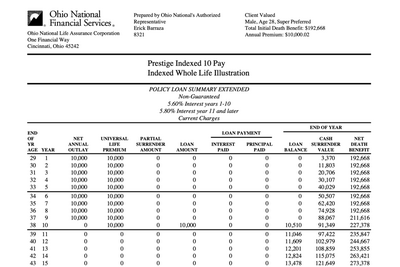

They sent me a letter last week terminating my appointment for lack of production, then now are sending me emails about their great new product.

All I know for sure is my one client with a bigger WL policy (paid up at 65 policy) with ON... on the in-force illustration, his dividend when paid up at 65, is projected to be 95% LESS than illustrated.

In all fairness, that is 5% better than what they said the worst could be & back then they never knew they would run the company in the ground & need to sell it to a pension fund from another country