phoenixlord

Expert

- 55

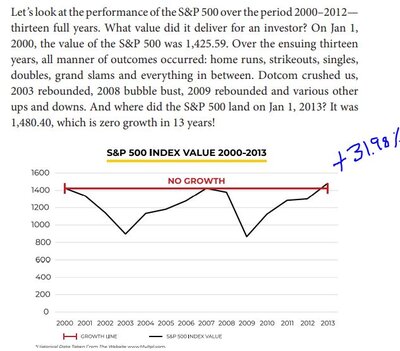

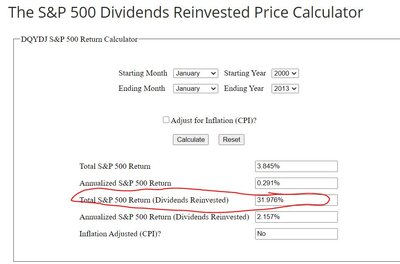

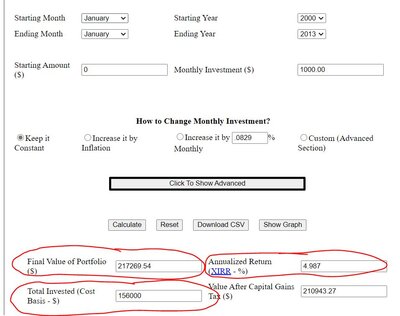

that was my thinking also & that flat years could hurt because of those costs. I would love to find an efficient way to do some of this with a portion my own equities portfolio as I tend to be more conservative than many. love to protect some of the downside & ok giving up some of the upside.

Thinking of researching some of the RILA products out there to compare

If you as an agent are not willing to pay 10% cost of insurance and that too when there is no cap on the upside, then you have no business recommending these IULs to your clients. If you don't have faith that you will come out with atleast 6% average on your portfolio in 20 or 30 years when you pay 10% cost of insurance, then how can you sell this whole IUL concept?