- 4,576

Because of the nature of term, it likely will be much more rare to be inforce than permanent when most people experience a need for care......but definitely a possibility.

I am not aware that medicaid will force a person to file a death benefit claim while they are still alive.

However, years ago I was told by a lawyer that agents & clients shouldn't put the terminal illness access rider on a policy until the insured wanted to use it. The lawyers point was similar to what you are thinking. His point was someone in dire financial straits with creditors, bankruptcy, etc could be forced to file an acceleration of death benefit to get cash to satisfy the creditor or bankruptcy, etc. I have never heard of that actually happening

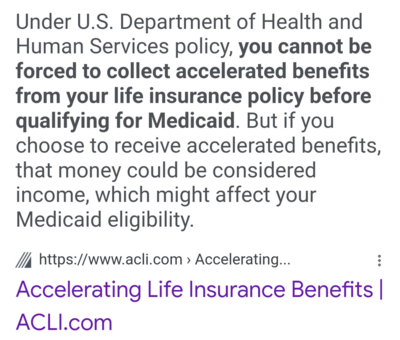

Here is ACLI actually stating Medicaid can't force claim to be filed but they will count the claim payments as income to be used for care, etc