Lloyds of Lubbock

Guru

- 714

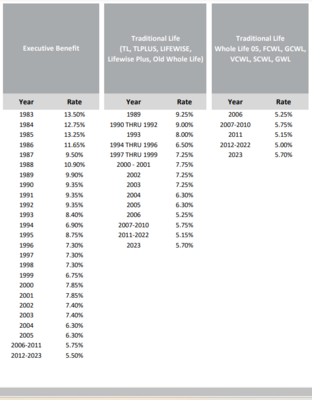

Nice bump for NY Life.

Years ago in these memos, companies would also speak to the other components of the dividend.

Mortality and Expense.

A company could raise it's rate and increase other expenses in the dividend to negate the increase.

Will be interesting to see what Mass, Guardian and Penn do

Years ago in these memos, companies would also speak to the other components of the dividend.

Mortality and Expense.

A company could raise it's rate and increase other expenses in the dividend to negate the increase.

Will be interesting to see what Mass, Guardian and Penn do