Al3x Lee

Guru

- 952

Looking back in hindsight, we know what caused the bubble that led to 2008, but now we find ourselves in a new situation that experts can't seem to agree upon. Some say that lending practices have become so much more strict than 15 years ago that another bubble like 2008 isn't possible.

What's your opinion? What do you think is causing the spike in housing prices? Do you think it's sustainable?

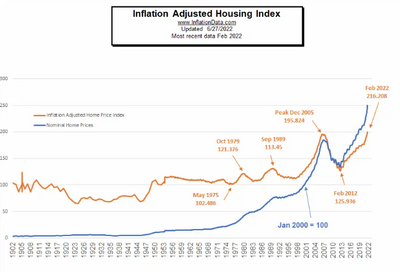

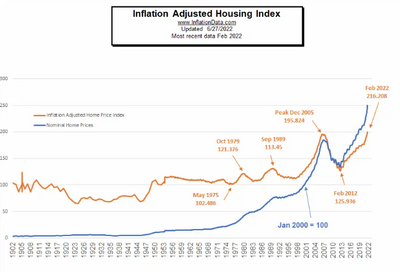

This data is old but still holds true into 2023, although it seems to have leveled out a bit.

What's your opinion? What do you think is causing the spike in housing prices? Do you think it's sustainable?

This data is old but still holds true into 2023, although it seems to have leveled out a bit.