- 11,292

Why is it that some of you are so hung up on "Ratings has nothing to do with how quickly a life insurance company pays claims." Nobody has ever said that. What was said is that the risk is higher for a lower rated company to be able to pay the claims. The stronger the financial stability the more likely they are to pay their claims in a timely manner. It is a correlation not a causation. We aren't talking about the process. We all understand the process that is not the point.

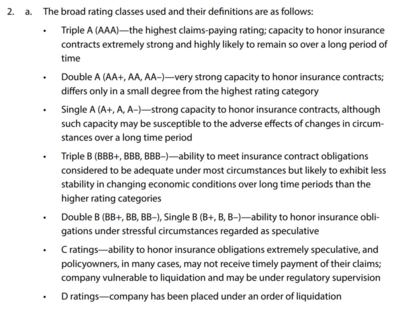

Because you are making a correlation that not even the rating agencies are making and expressely stated in their own material.

Now, you can say that you have observed things based on the ratings of the company... but that's an observation from experience, not an industry fact.