- 4,576

My dad retired with a ira 25 yrs ago . Started taking end’s at age 70 . He’s 91 now . His ira was $500 k in 1999 .His rmd’s big now because he’s lives far longer than the avg distribution table . Because of tremendous returns his Ira’s still near $500 k even after 21 years of distributions . My question will they force his distributions s high if he lives another 5 yrs the account goes to zero fast ? The irs wants there tax money . They dint want this passing as inheritance

PS-- when your dad 1st retired in 1998, the laws on RMDs were different. When you turned 70, they said you had 16 year life expectancy & had to take 1/16th of your money that year & then it changed by 1 each year (1/15, 1/14th) until at age 86 all of the money had to be completely emptied.

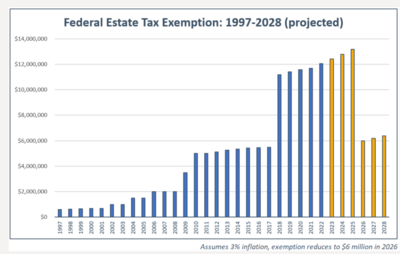

Over the years, the IRS/government changed not only the RMD tables a few times & even postponed RMDs until 72 & soon to be 75. They also lowered the amount you have to take each year & now it doesnt change by a factor of 1 each year & can last way past age 100.

Everyone praised these changes, but the IRS & government are not stupid. they realized by forcing out all the IRA money between age 70 & 86, when most seniors are in low tax brackets or 0% tax bracket, they had defacto let people save for retirement & deduct the contributions while working in higher tax brackets but then empty the accounts when in low tax brackets or 0% tax bracket. (IE-- IRS missed tax revenue when deposits were made & missed tax revenue when seniors took their RMDS)

Fast forward to today, much smaller RMDs & they dont start until age 75. This means much larger IRA balances still on the books at death & children inheriting them while still working, either in a lump sum or within 10 year timeframe as inherited IRA.

Much, much, greater tax revenues for the IRS under the current RMD tables & RBD of age 72 or 75 than when you had to empty it fast between age 70 & 86