AnnuityGuy63

Expert

- 53

Yes I know that Silac was downgraded and for some reason there is a lot of hate going on for them....

But my client just received his 11 month Denali Reallocation Letter.

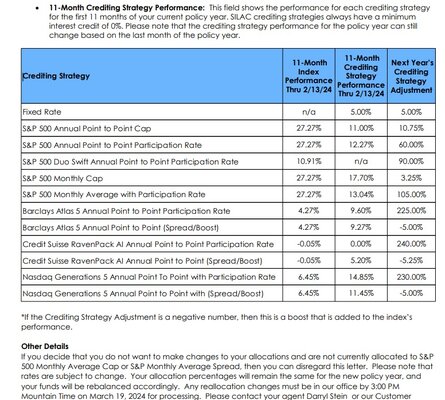

Client wanted 10% in the fixed bucket and 90% in the SILAC NASDAQ G-5 TPT with 230% Par.... The letter states 14.85% return. Now that doesn't mean in 30 days that's what it will be but it's a fair estimate.

And my client is very happy with that return. The client has systematic withdrawals turned on to execute his RMD's on a monthly basis so even if SILAC got in trouble and went into receivership my understanding is that since payments have started they can't stop.

Can anyone confirm or correct me on this?

But my client just received his 11 month Denali Reallocation Letter.

Client wanted 10% in the fixed bucket and 90% in the SILAC NASDAQ G-5 TPT with 230% Par.... The letter states 14.85% return. Now that doesn't mean in 30 days that's what it will be but it's a fair estimate.

And my client is very happy with that return. The client has systematic withdrawals turned on to execute his RMD's on a monthly basis so even if SILAC got in trouble and went into receivership my understanding is that since payments have started they can't stop.

Can anyone confirm or correct me on this?