- Thread starter

- #81

phoenixlord

Expert

- 55

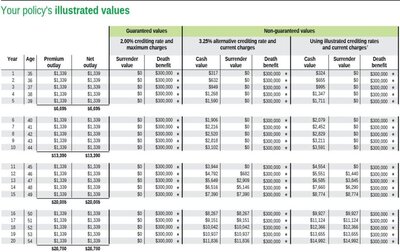

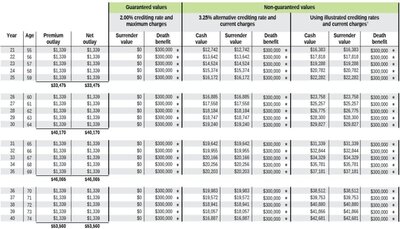

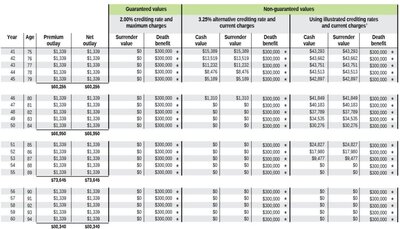

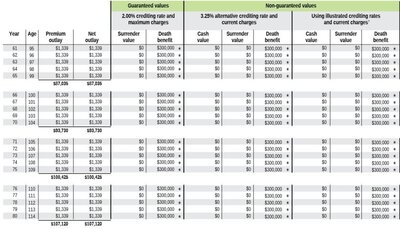

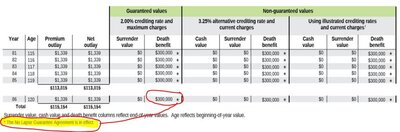

No lapse is only good for 15 years in IUL. There is a no lapse UL but no no lapse IUL. You can design so that the IUL doesn't lapse even in the guaranteed column which has max expenses,min credit by selecting CVAT method(DB will drop if resorted to max expenses) but other than that there is no no lapse IUL. Can you shown an illustration? IUL is a horrible product for max funding or min funding. Risk has been transferred back to the policy holder.a no lapse IUL