- 4,609

So let's sum up (again):

NYL agent originally sold a $600k WL policy with premiums of $12.5k per year.

Same agent leaves NYL to go to MassMutual.

Because the now MassMutual agent cannot service the NYL policy, BUT can replace the policy AND create substantially similar premiums while increasing coverage (looking at a cost per thousand), replaces old NYL policy for the MassMutual policy for a total of $1.1m of coverage for $22k annual premiums while doing the 1035 exchange to preserve the tax status of the existing cash values.

Oh, and did the replacement 6 years after the original policy was in-force, thereby being in compliance with his non-solicitation agreement (not to replace for 2 years). Which is also pretty damn good because you're 6 years OLDER and STILL got substantially similar premiums.

I see absolutely nothing wrong with this.

agree if both policies are truly both entirely whole life & not UL or term riders involved. If client got a better risk class & new policy projected & guaranteed illustrated as good or better than existing policy.

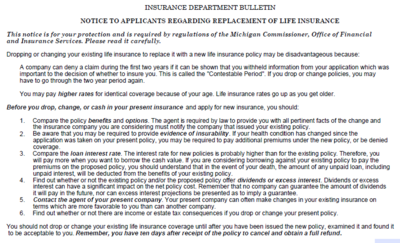

however, 2 year contestability is & was a real risk in cases like this. I just think "not being able to service an old policy" is a horrible justification for replacement itself.

When I was producing & managing producers, we encouraged hundreds of clients to keep their old Northwestern Mutual, Mass, NY Life WL policies & supplemented with new permanent or term. Agents kept copies of policy info to assist beneficiaries to file claims in the future. In many cases, also advised clients on how to call the carrier to ask questions on how to fix some loan problems on policies where they could have dividends apply to pay down loans, etc.

Restarting surrender charge periods or going through new early year high cost years can rarely be guaranteed to be better for client when new policies today generally have much lower guaranteed interest rates embedded & lower dividend scales due to the long low interest rate environment

Need more specifics to know if this was good or bad for client, but I am still not sold that the old policy was improved by being moved. Likely met a suitability standard, but may not meet a best interest standard like is the case with Annuity products in most states.

regardless, the client was responsible to read the documents he signed & likely signed one like this. however, it is cases possibly like this in the annuity industry that have led to Best Interest regulations being implemented where producers jump ship from company to company & churn the account values because it is easier to call existing clients than to find new prospects who have no coverages