- 4,576

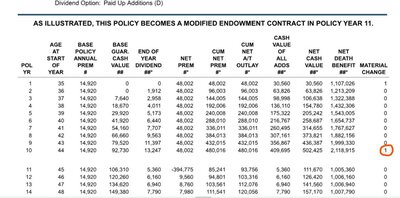

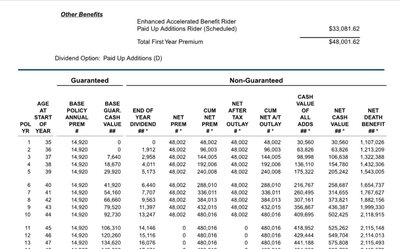

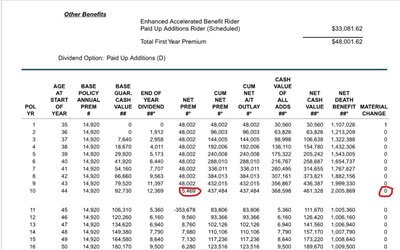

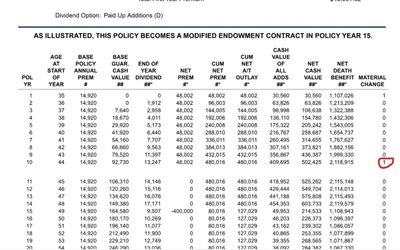

When you put a substantial amount of PUA in a policy you may create a material change.

That would subject the policy to a 7 pay test.

If you take a large withdrawal you will also create a material change and the policy will look at the lowest db in relation to premium...this may create a mec.

A recapture ceiling is a money money out regulation to detect money laundering.

If you trigger this your distribution is taxable

To be clear, isnt your illustration attached becoming a MEC because of the planned premiums going in, not because of partial PUAR surrenders? If the policy was set to avoid MEC & the carrier also doesn't allow excessive premiums that cause MEC without MEC notice signature by Client, wouldn't this be avoided?

I have some large WL that are non MEC that had lump sum PUAR go into them & annual max PUAR just below 7 pay/MEC Premium threshold. Have seen hundreds like it without becoming MEC. Have not seen a partial surrender of PUAR have it cause MEC yet.

Have seen tons of ULs have those issues, but that is normally from a gave reduction or a level face withdrawal causing face reduction or combination of change to smoker class & all of the above.