- 4,576

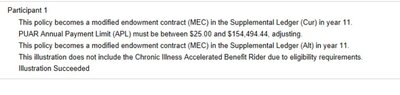

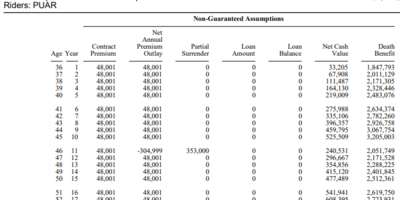

Lets be very clear the policy is clearly a mec because of the withdrawal.

Had I not taken the withdrawal the policy would not MEC .

The PUA caused a material change the withdrawal caused the policy to become a MEC.

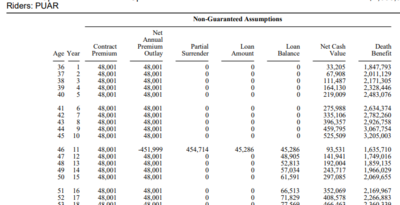

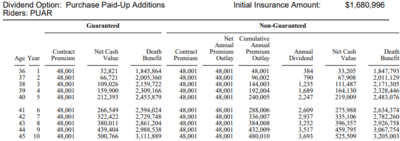

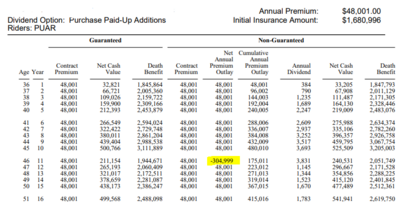

Here I have included a picture showing where the material change takes place.

The distribution caused the policy to fail a 7 pay test.

I have only triggered a recapture ceiling by accident and had no idea what it was, so I had to call actuarial.

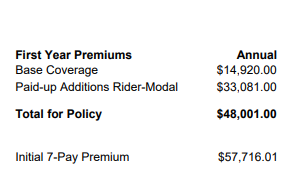

I used Guardian software for this. Penn is very similar. They both have fields to check off to prevent this.

Mass more plug and play.

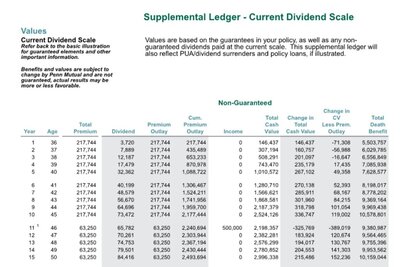

tried to match up to this illustration. I put in large 11th year Surrender of PUAR & not showing it triggering MEC on the illustration (could be carrier flaw).

I even jacked up the 11th year distribution to $500k. $454 PUAR surrender & balance as loan & still didnt trigger the MEC symbol. Soooo, could be a software problem or something & will be talking with actuaries & tax people on this.

Note-- I matched the PUAR you had on here, but this policy would have taken another 11k into PUAR for a total of $44,500 PUAR & $14,920 base & been under the $59,471 7pay premium