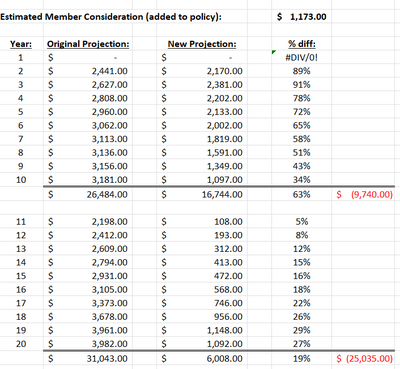

So we know they are trying to go through with the sale. Voting has been sent out, and apparently a "payout" or "settlement" has been offered to clients, on the demutualization.

Anyone familiar with that that actually looks like for the customers?

I wonder what the future holds for clients holding large WL policies?

Anyone familiar with that that actually looks like for the customers?

I wonder what the future holds for clients holding large WL policies?