- 2,110

You obviously have never read some of the FE contracts that are out there.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You obviously have never read some of the FE contracts that are out there.

How do you not know these things?

Agreed. Which was why I qualified my post assuming that it was an FE policy issue.

It's not just FE. It's any life insurance.

Agreed. Which was why I qualified my post assuming that it was an FE policy issue.

Fully underwritten WL policies paid annually refund consumer unearned premiums when surrendered mid year. This is true in 1st year or subsequent years. If premium is 1200 a year & cancelled 3 months into a policy year, 9 months unearned premium will be refunded as part of cash surrender value

I don't sell the same companies you do, apparently.

View attachment 8798

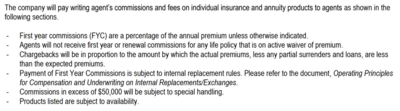

Point #2: No chargebacks in the event of death, but no FYC if it is on active waiver of premium.

Point #3: Actual premiums less any partial surrenders and loans are less than expected premiums. Doesn't say anything about refunding commissions in the event of death.

Point #4: I'm not doing internal replacement. If I was, I would expect it to be handled differently anyway.

Now, this is further in the commission agreement:

View attachment 8799

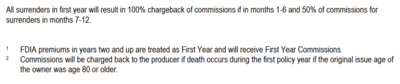

Surrenders in the first year... okay, that's there.

Commissions charged back in the event of death if the ORIGINAL ISSUE AGE of the owner was 80 or older.

What's my point? Read your commission schedule and agreements.

Not everything is as anyone else says. Read what's in writing.

Fully underwritten WL policies paid annually refund consumer unearned premiums when surrendered mid year. This is true in 1st year or subsequent years. If premium is 1200 a year & cancelled 3 months into a policy year, 9 months unearned premium will be refunded as part of cash surrender value