- 5,499

In one of the Colorado Bankers threads, @scagnt83 said the following:

It is a fact that many of the carriers that offer Final Expense, aka Simplified Issue Whole Life contracts are not rated by any of the financial ratings agencies. When I first landed here about 5 years ago or so, using "A" rated carriers seemed to be advoctaed by several forum participants. But now, the issue of financial stability and creditworthiness seems never to come up when speaking final expense.

So, let's talk about ratings ... should we continue to write for companies that have not been vetted by a 3rd party such as AM Best, S&P, etc?

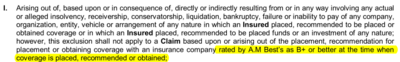

Do you know if your E&O will cover you for a claim with a carrie not rated A or higher?

How do you feel about financial strength ratings? Do they affect your carrier selection or not at all?

B++ is the bottom 40% of all US carriers. Not a strong rating at all. Not covered by an agents liability insurance its so risky of a rating.

It is a fact that many of the carriers that offer Final Expense, aka Simplified Issue Whole Life contracts are not rated by any of the financial ratings agencies. When I first landed here about 5 years ago or so, using "A" rated carriers seemed to be advoctaed by several forum participants. But now, the issue of financial stability and creditworthiness seems never to come up when speaking final expense.

So, let's talk about ratings ... should we continue to write for companies that have not been vetted by a 3rd party such as AM Best, S&P, etc?

Do you know if your E&O will cover you for a claim with a carrie not rated A or higher?

How do you feel about financial strength ratings? Do they affect your carrier selection or not at all?