MrInsurance12345

New Member

- 3

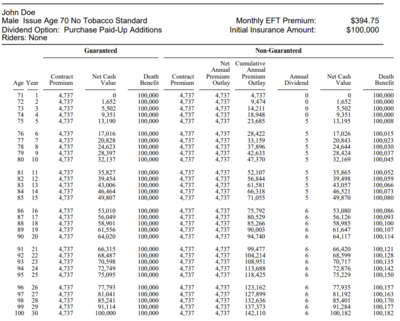

I did a Google search and it said that you can get 100K in coverage for about $230 a month at age 70. Now of course assuming that the person was in good health and was able to pass the medical exam, why wouldn’t most people just buy the whole life policy instead of the final expense policy?

I also do realize that the whole life policy might take several months to pay out when the funeral money is needed. But if the person’s objective was to buy a policy for more than 10K (the cost of a funeral), wouldn’t it be better to get a whole life policy?

Or at least a 10K final expense policy and the rest with a whole life policy?

Am I missing something here? How do I hear about people taking $400 a month FE policies?

I also do realize that the whole life policy might take several months to pay out when the funeral money is needed. But if the person’s objective was to buy a policy for more than 10K (the cost of a funeral), wouldn’t it be better to get a whole life policy?

Or at least a 10K final expense policy and the rest with a whole life policy?

Am I missing something here? How do I hear about people taking $400 a month FE policies?